(Image: Quoting the source, "A German woman feeding a stove with Papiermarks, which burned longer than the amount of firewood people could buy with them.")

I am interested to see what real value these government 'gilts' have. Maybe above zero? (Just a vague presumption.) Where did they come from? From what real assets is their value sourced?

I decided to look on DirectGov's website, on a page aiming to convince people to "invest" in gilts, just to see what fun flowery language they used in order to dodge the fact that they have 0 real value. Fun quote time!

"Gilts (or gilt-edged stocks) are bonds issued by the government which pay a fixed rate of interest twice a year. They are considered safe investments as the government is unlikely to go bust or to default on the interest payments.

However, you are not guaranteed to get all your capital back under all circumstances. Gilts, like corporate bonds, are bought and sold on the stock market where their price can go up or down."

And from the same page - admittedly about a different investment, but I loved the wording enough to want to bring it up here...

"Bond funds invest in several bonds (including corporate and government bonds) with different interest rates and different maturity dates. This reduces the risk to your capital. But because of the mix of investments, bond funds can't promise a fixed return; instead they aim for a 'target return'." (Oh, and I thought the stock market wasn't a scam...)

I guess, if Obama can convince people to invest in hope not backed up by anything real, then likewise the establishment can also sell these unbacked "assets".

.jpg)

2 comments:

Your blog is impressive. Wow!

I want to disagree with one point I caught. It is not true that the boom-and-bust business cycle began with the creation of the Federal Reserve system.

The Federal Reserve came into existence in 1913 (you probably knew that), but boom and bust business cycles had already existed for centuries.

There's probably a lot wrong with the Federal Reserve, but money and banking problems were even worse back before it was created.

True about the business cycle. I'm not saying there was no boom and bust before, but now we have artificial, controlled, and possibly greater booms and busts than before. Also, it would hardly be 'paradise' if we were to restore capitalism (end the Fed), but at least we wouldn't live under a fraud. I agree w/ Thomas Jefferson on the issue of money:

"If the people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will

grow up around them (around the banks), will deprive the people of their property until their children will wake up homeless

on the continent their fathers conquered."

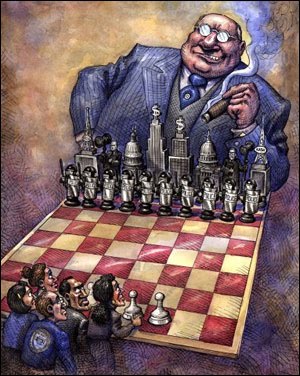

They pump the economy full of cheap credit, people buy into the 'boom' and its guaranteed returns, then they pull the plug on the credit. The economy collapses, prices fall, and they are the only people still with their fortune (bailout), they use it to buy up the economy at knockdown prices.

Thanks for the compliment too :)

Post a Comment